KAISER LONG TERM

The Ultimate Kaiser Health Builder Plan is a healthcare plan that allows one to control his own health and provide for his own future.

KAISER LONG TERM CARE MAIN FEATURES

Kaiser International Healthgroup, Inc. is an actuarially-sound, product-based business. It brings together the best features of an HMO, Health Savings Plan, and a financial investment.

- An innovative program, the first of it's kind in the country;

- Guarantees long-term care even after the age of sixty when the client has only himself to rely on;

- Healthcare coverage, savings, emergency fund, and insurance rolled into one;

- An accumulative, self-earning investment that comes with Return of Payment for non-utilization in the first seven (7) years of coverage;

- A portable account! Even if you change or lose jobs, your plan and funds stay with you;

- A four-way insurance coverage:

- Term Life

- Accidental death and dismemberment

- Waiver of installment due to death

- Waiver of installment due to permanent and total disability;

- Outpatient benefits, annual physical examinations and dental coverage;

- Coverage is for individuals but can be installed in companies as a health savings salary deduction program;

- No exclusions from 8th year onward;

- Flexible, Upgradeable within 30 days ;

- Annual lifetime healthcare benefits from years 8 to 20 accumulate with interest in a "Health Savings Account"

- "Health Savings Account" earn interest beyond 20 years.

- Benefits can be used up to any age.

- Payable in 7 years only with fixed rates for the entire paying period;

- Issue age up to 60, but coverability extends after 60; and,

- Reinstatement can be done within 2 years after lapsed policy.

KAISER VIDEO EXPLAINER

LEARN KAISER'S AMAZING BENEFITS AND FEATURES IN OUR VIDEO EXPLAINER

Still worrying about your future health needs? Have your peace of mind by investing in your long term health care

FREQUENTLY ASKED QUESTIONS

NEED MORE ANSWERS? Read our answers from other questions about Kaiser Long Term Care

Stable ba ang Kaiser? Paano ako makaka siguro dyan? Paano pag nag sara ang Kaiser? Totoo ba yan?

ANSWER: Lahat naman ng products may risk, tignan mo na lang kung saan nag iinvest ang Kaiser. Ang Kaiser ay nagiinvest sa diversified companies ranging from real estate, telecom, bank, food and iba pang industries. Hindi naman sabay sabay bumabagsak ang mga industries.

Insurance company ba ang Kaiser? Legit ba yan?

ANSWER: Ang Kaiser ay isang "Health Maintenance Organization" duly accredited with the Department of Health - Bureau of Health Facilities and Services. You can visit the Insurance Commission's link: https://www.insurance.gov.ph/regulated-entities/health-maintenance-organization/

Paano kung di ako makabayad? Paano kung mawalan ako ng trabaho at di ko na matuloy ang pagbabayad? Magkano makukuha ko pag di natuloy?

ANSWER: Pag di ka naka bayad sa due date, may grace period na 60 Days. If di ka naka bayad within the grace period you have two options:

1. Update: member will pay the premiums due on all missed months + Surcharge of 1.5% per month or 18% per annum from the date of each unpaid installment.

2. Redate: member will only pay the premium for the month but the maturity date will be moved.

*magkano makukuha ko if ever? May tinatawag na cash value surrender: Meaning nito ay the owner may surrender the contract for its cash value stated in the Schedule of Benefits provided the Plan is active for atleast a year.

or Pwde i-transfer sa ibang tao na pede magtuloy nito.

56 Years old na ako pwede pa ba? 3 years old anak ko pwde na ba?

Answer: Yes, ang Kaiser's eligibility is from 10 years old to 60 years old. OR else pwede ka kumuha ng dalawang plans both under your name then pag 10 na anak mo pwede mo itong itransfer sa kanya. Or intayin mo na lang na mag 10 sya.

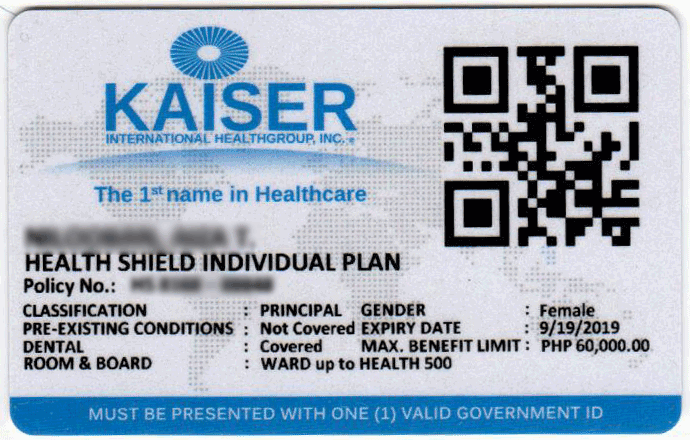

Covered ba pati family ko?

ANSWER: NOPE, the plans are individual plans di ma cocover family mo unless kukuha ka ng family coverage package. Pero ang bawat plan ay mayroong FAMILY Assistance feature kung saan if may member ng immediate family na need ng emergency pwedeng si Kaiser muna magbayad nito pero subject for approval. Ikaw at si Kaiser na maguusap if paano mo ito mababayaran.

Pwede po bang mag loan or magwithdraw sa funds ko?

ANSWER: Pwede kang mag withdraw sa funds mo after 20 years or mature na ang iyong fund.

Pwede ba akong kumuha ng Kaiser kahit nasa ibang bansa ako?

ANSWER: YES! Maraming OFW ang may Kaiser plans. You can fill up an online form para makakuha ka ng plans mo.

CLICK MO LANG YUNG WORD NA REGISTER:

Pwede ba ako mag change of mode of payment? Halimbawa monthly to annual?

Answer: Yes pwede mo ichange from monthly to annual. Once na upgrade ung mode of payment di na pwede itong ibalik sa monthly. May other mode of payment: Spot cash, monthly, quarterly, semi annual or annual. Pwde ka anytime mag upgrade ng payment.

Pwede ba ako mag change ng Plan Type

ANSWER: Yes, pwede ka mag palit ng plan type 30 days after an approved policy. Di Allowed ang downgrade ng plan type form higher to lower plans.

Kailangan bang IMG member ako para makakuha ng Plan?

ANSWER: Hindi mo kailangan maging IMG member para makakuha ng Kaiser. But we high recommend to be a member because of its 30+ membership benefits.

Covered po ba diyan ang consultation?

ANSWER: During the first 7 years (paying period) the member cant use the outpatient service like consultation. But after the paying period, the consultation is covered. You can also be a member of IMG dahil may unlimited FREE Consultation ang member sa mga Kaise Medical Clinis.

Anong pinag kaiba ng Short term Vs Long Term Care

Maraming pagkakaiba ang dalawa. Upang maunawaan tignan ang pag kakiba nila sa baba.

Short Term

- Renewal is not guaranteed

- Yearly increase of premium

- Generally, no insurance coverage

- No accumulation of unused health fund

- No return of premiums (ROP) for non utilization

- Covers up to age 60 only.

- Pre existing illness is not covered during the 1st year and lifetime / permanent exclusions may be issued on the 2nd year onwards.

- Inflexible, non transferable benefit design

- Reinstallment is limited only within 30 days of lapsed policy.

- Access to non-accredited physicians and medical network is not covered.

- Continuous yearly payment terms.

- Anxious, worrisome, and insecure healthcare status after employment or during retirement years.

Long Term

- Renewal is guaranteed.

- Fixed Premium for 7 years

- With 4 way insurance coverage up to the Long Term Plan.

- All unused health fund accumulated with interest.

- Covers beyond 60 with long term care yields.

- Pre-existing is not covered during the accumulation period. No exclusions after the 7th* year of coverage.

- Flexible, transferrable, and may be redated benefit design.

- Reinstallment within 2 years of lapsed policy.

- Access to non-accredited physicians and medical network is covered after the 7th year

- Out-patient medicines and all illness including cosmetic and maternity are covered after the 7th year*

- Seven (7) years or spot-cash payment options

- No worries.

Senior Care

- Medical healthcare plan especially designed for those ages 61 years of age and up.

- Reimbursement of actual hospitalization expenses based on coverage.

- Reimbursement may be done midway of hospitalization provided confinement is coverable and required documents submitted.

- Patient’s choice for doctor, hospital and specialist.

- Comprehensive range of Medical Healthcare Benefits with a maximum coverage limit of up to Php1,000,000.00

- Member to shoulder the 1st P10,000.00 from the total bill plus an additional 10% of the claimable amount. The remaining 90% of the claimable amount shall be shouldered by Kaiser.

- Surgical Cases are based on PhilHealth RUVs to calculate the maximum amount payable to the surgeon for the surgical procedure. This means that the payment received from Kaiser may be less than the professional fee charged by the surgeon.

- Coverage is one (1) year upon effectivity of the plan.

- Renewal is guaranteed up to age 100. However, KAISER reserves the right to adjust premiums and other policy conditions upon written advice of 45 days prior to renewal.

How comfortable is your health care situation after age 60? It will depend on your decision you make today!

Have that peace of mind by investing as early as now!